Saturday, 4/13/13

My husband and I used the ATM inside Walmart on Battlefield Parkway, Ft. Oglethorpe, GA, to withdraw $300.00 from the checking account where Robert's check had been deposited the day before. This is a normal activity for us; we use that ATM weekly. We are always careful when using any ATM, and did not notice anything out of the ordinary. After the $300 withdrawal, there was a balance of $240.59 in the checking account. That money was earmarked to pay our power bill and part of our house payment.

There was no way to know it at the time, but a thief had apparently installed a card-skimming device on or in the ATM, which scanned Robert's debit card and stole the information off of it. [EDITED TO ADD: EVEN THOUGH SUNTRUST BANK FELT THE ATM WAS THE SOURCE OF THE PROBLEM, IT TURNED OUT TO BE MAPCO GAS STATION - MORE BELOW.] The thief then made a duplicate of Robert's debit card, which would work just like Robert's original card. Robert's card never left his possession. In fact, he still has it, even though it has been deactivated. Also, it has never been used online.

The thief headed to Atlanta with the duplicate card. He (or she) made several purchases as follows:

4/14/13 - $19.04 Citgo #Q39 Lithonia, GA

4/15/13 - $52.93 Kroger #259 Atlanta, GA

4/15/13 - $57.90 Kroger #259 Atlanta, GA

4/15/13 - $86.85 Kroger #259 Atlanta, GA

4/15/13 - $86.85 Kroger #259 Atlanta, GA (not a duplicate)

Here are the transactions as listed in the bank account. All account numbers and other private information has been marked out on all photos.

The thief's purchases added up to $303.75, which was more than the $240.59 we had in the checking account.

We had purposely declined overdraft coverage beginning the very day we opened our Suntrust accounts, but we found out the following day (4/15/13) that Suntrust had accidentally turned overdraft coverage back on, as per the Branch Manager and Assistant Vice President, Ms. Adala Bailey. If they hadn't made that mistake, the thief would've been stopped in his/her tracks when the balance in the checking account hit zero. Instead, Suntrust started pulling the money from our savings account, which they were also not supposed to do. The accounts were not supposed to be linked.

The thief tried to make more purchases, but MasterCard realized there was some suspicious activity, and started declining the card after that. One of the declined purchases was a Publix in Atlanta, but I don't know the dollar amount.

Monday, 4/15/13

MasterCard alerted the bank, who called Robert on Monday evening, 4/15/13. Robert had just arrived at work. He's not allowed to take phone calls while at work, so he had to let the call go to his voice mail. He listened to the message and slipped off long enough to call me (his wife) and give me the message. I logged into the bank's website, saw the balance was -$62.98 (negative), and hurriedly called the bank back. They flat refused to talk to me, even though I am on the account too. They insisted on talking to Robert. So Robert had to get permission from his boss to make the call, risking getting in trouble. He quickly confirmed with the bank representative that those purchases were indeed fraudulent, and Suntrust shut down the account until he could get back in touch with them as soon as he got home from work on Tuesday morning.

Tuesday, 4/16/13

On Tuesday morning, we both went to the bank as soon as the doors opened. We talked to Ms. Adala Bailey, the Branch Manager and Assistant Vice President, who seemed very nice, and got everything straightened out for us ... or so we thought. We signed an "Affidavit of Fraud" to confirm that those charges weren't ours, and Ms. Bailey replaced the stolen $303.57 right then. That brought our balance back up to the correct amount of $240.59. Below is a photograph of the "Affidavit of Fraud".

When we asked why Suntrust had let the balance go below zero and why they had dipped into our savings, that's when Ms. Bailey found that overdraft protection had been turned on by a mistake on the their end. On the replacement money, she said it was temporary, but said that the actual replacement money would be there in 3-5 days. Robert made a note of this on our paperwork while we were talking to her. I was sitting right beside him, and can confirm that this is the information we were given. Here is a photograph of his notes.

She even said that the temporary money and the "real" money would most likely "overlap", and would briefly be in the account at the same time, and not to spend the extra money (it wasn't necessary to tell us that, as we'd never spend money that isn't ours). Ms. Bailey felt sure that Robert's debit card information had been stolen at the ATM inside Walmart on Battlefield Parkway, Ft. Oglethorpe, GA, because they'd already had one other complaint that morning where the same thing had just happened to somebody else. [EDITED TO ADD: THIS TURNED OUT NOT TO BE THE CASE. THE BREACH OCCURRED AT MAPCO GAS STATION. SEE BELOW.] Everything seemed to be taken care of.

While there, we opened up a second checking account to be used for expenses only. After discussing it with Ms. Bailey, we all agreed that it would be safer to have our debit cards tied to the expense account, and transfer exactly the amount of money to that account on an as-needed basis. We made doubly-sure that overdraft protection was OFF, and she assured us that it was.

Then all three of us walked outside to the ATM so Ms. Bailey could show us several ways in which a thief could disguise a card-skimming device and/or a camera. Do note that we saw none of these things at the ATM inside Walmart, but perhaps it was exceptionally well-hidden. [EDITED TO ADD: IT WASN'T A TAMPERED-WITH ATM AFTER ALL. SEE BELOW.]

After we left the bank, we filed a police report in Ft. Oglethorpe, GA. We got the distinct impression that that our complaint wasn't being taken seriously, but we filed the report nonetheless. The police officer made a copy of the "Affidavit of Fraud" from the bank for their records. Here is a photograph of the police report, with personal information and names marked out.

Wednesday, 4/17/13

On Wednesday morning, we got a call from a Ft. Oglethorpe detective, who basically acknowledged that we filed the report. He didn't say much else. Robert asked him how often these types of thieves get caught, and he said it was rare.

Thursday, 4/18/13

We got a copy of the police report from the Ft. Oglethorpe police station. We noticed that they'd made a notation at the bottom saying "complaint unfounded". Perhaps "unfounded" has a different meaning in law enforcement than the regular dictionary definition, but that pretty much confirms to us that our complaint wasn't taken seriously.

I'd been keeping a close eye on our bank accounts all this time, to make sure the "real" replacement money arrived like Ms. Bailey with Suntrust said. Other than a $1.39 purchase, which made our balance $239.20, we hadn't used the account at all, just to be sure, even though the bank lady said the temporary money was there for us to use. And as it turns out, it's a good thing we didn't touch it.

On Thursday evening, the temporary replacement money totally disappeared from the account, leaving us in the red once again, at -$64.37, and the fraudulent charges that had been showing as "pending" showed up as actual charges. We'd deposited a $50 check from a family member that morning, and Robert's paycheck came in at 3am Friday morning. Because the balance was negative again, the bank "soaked up" the whole $50 check that my father had given me, and $14.37 of Robert's paycheck, to bring the account back to positive. In effect, this money is being held hostage. We cannot access it.

There was no sign of the "real" replacement money at all, even though Ms. Bailey said it would be there by that time.

We also received a nasty e-mail threatening to charge us overdraft fees since the account had gone negative when the $303.57 credit was suddenly taken away. Here is the e-mail:

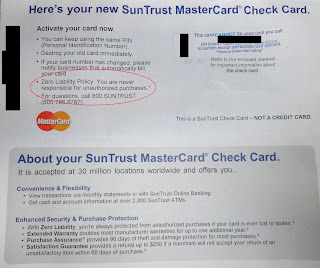

Also, in the mail, we received a notification "thanking us" for choosing overdraft protection for the newly-opened spending account. What??? As with our other accounts, we'd purposely refused overdraft protection on the very day that the accounts were opened! Here is a photo of the notification:

Friday, 4/19/13

Again, as soon as the bank opened on Friday morning, Robert was there, trying to find out what happened. Overdraft coverage was supposed to be turned off! He was told that they'd fix it.

He was also told that they were doing an investigation and that it'll now take 10 days to get the money back. Previously the Branch Manager and Assistant Vice President, Ms. Bailey, had said 3-5 days. Ms. Bailey was unavailable at the time Robert was there. The man he spoke with couldn't provide an actual answer as to why the temporary money disappeared before the "real" replacement money arrived, pretty much down-playing the whole thing. In other words, "tough luck". Robert has to be at work early on Fridays, and he wasn't getting anywhere with the bank, so he came home so he could get at least a little bit sleep (a whole 3-1/2 hours' worth).

Regarding the bank's comment about an investigation, we kind of got the impression that WE are under the microscope, so to speak. I hope they don't think we had anything to do with this, because we certainly didn't. Should they require proof that we were not in Atlanta on those days, we can easily prove it. For the record, we have not been to Atlanta in several years. The closest we've been is Norcross last year at a bird fair, and Canton about 3 months ago to buy some English budgies from a breeder. We have not been as far south as Atlanta in a very long time, and we certainly didn't make a 3+ hour round trip just to shop at Kroger and get gas. I have additional proof available, but here are some receipts where we'd shopped locally on those two days, along with a screen capture of where we rode our bikes in Chickamauga Battlefield for almost 2 hours on the morning of 4/14. This is recorded via GPS and uploaded to MapMyRide's website at the end of the ride. Again, Robert's debit card has never been out of his possession. And for the record, we only have one vehicle.

Also on Friday, 4/19, we received Robert's replacement debit card. On the paperwork included with the card, it clearly states, "Zero Liability Policy: You are never responsible for unauthorized purchases". There is a little "1" beside it, denoting that there is additional information on the paper. On the back it says, "Zero liability protection does not apply to ATM transactions or to PIN transactions not processed by MasterCard, or certain commercial card transactions. You must notify us promptly of any unauthorized use."

1. All of the fraudulent transactions occurred at stores, Kroger and Citgo. There were no fraudulent transactions at an ATM.

2. None of the fraudulent transactions were PIN transactions not authorized by MasterCard. Unless the PIN number is coded onto the copied debit card, the chances of the thief having Robert's PIN number is slim to none. It is not written down ANYwhere. And surely large stores like Kroger and Citgo use MasterCard to authorize their transactions.

3. This is a personal debit card that has not been used in any commercial card transactions.

4. The bank was (very!) promptly notified about the unauthorized purchases. They called us, and we returned their call almost immediately, and we were at the bank's door when they opened the following morning.

So .... since none of these conditions apply to us, what could possibly be taking Suntrust so long to resolve this?

Here are photos of the paper to which I am referring:

Saturday, 4/20/13

After much discussion, on Saturday morning, as soon as the bank opened, Robert went and pulled everything out of the savings account, except for the $100 minimum balance, and left the compromised checking account with $28.21 in it. We felt it was the only way to make sure Suntrust didn't dip into those accounts again and take what isn't theirs. The money is being kept in a secure location.

Monday, 4/22/13

We received two letters from the bank. One letter was letting us know there had been recent suspicious activity (as if we didn't know that!), and the other letter was a note saying they've waived 3 overdraft fees (which they're not allowed to charge us, anyway!), and saying we have a negative balance, which we DO NOT, thanks to them "soaking up" that $50 check and part of Robert's paycheck. Grrr! I hope the card just got crossed in the mail, because the correct balance as of this date is $28.21. It does show up correctly online.

There is still no sign of the $303.57 replacement money.

Friday, 4/26/13, will be 10 days. Robert and I have decided that if the replacement money isn't there by then as promised, it'll be "stink-raising" time. They say they completely cover fraudulent activity, and they better stand by that, if they want to keep our business (actually, that part's already "iffy").

That evening (4/22/13), I posted the following on Suntrust's Facebook page. The squeaky wheel and all.

I'm posting here regarding the stolen money from my and my husband's checking account. My husband's debit card was "skimmed" at a local Suntrust ATM, according to the branch manager. The thief then made a duplicate of his card and went on a shopping spree in Atlanta, 1-1/2 hours from where we live. We've been in contact numerous times with both the fraud department and two of the local branches, but are being given conflicting information, and as of yet, there has been no resolution at all. First we were told we'd have the money back in 3-5 days, but now are being told 10 days, which will be Friday, 4/26. The bank also made an error (admitted by the branch manager), and they somehow turned overdraft protection ON when it was supposed to be OFF. This mistake allowed the thief to drain our checking account into the negative, which then carried over into our savings account, as the fraudulent purchases were being paid. The branch manager did say she will take care of any overdraft fees, which is appreciated, however, we need to be reimbursed for the stolen money ($303.57) so that we can get our finances back in order. In the meantime, you are holding a recent deposit and part of my husband's paycheck hostage, to make up for the negative balance resulting from the stolen money. This is very upsetting, because we have bills to pay just like everyone else. We have withdrawn the money in our savings account for safekeeping, and have filed a police report. I hope this issue is resolved by 4/26 as promised, so that we can remain a Suntrust customer. Sincerely, Robert and Lisa (last name edited out), (city and state edited out).

Tuesday, 4/23/13

Suntrust responded to my complaint on Facebook with:

Hi Lisa - we're sorry to hear about your experience. We know how stressful situations involving fraud can be. We're connected to the Claims Department and can request an update from them. If you're open to this, please send us an email including your name as it appears on the account, zip code, and preferred contact number to AskSunTrust@SunTrust.com.

I said:

We received a phone call yesterday afternoon saying the reimbursement would be deposited last night, and that it would be available this morning. It appears that the deposit has been made. Thank you for taking care of this. Hopefully everything's all settled now. If possible, could you let us know if the thief is caught? I'd very much like for the creep to be apprehended so that he/she doesn't do this to anyone else.

The account balance was now $311.78 ($28.21 previous balance + $303.57 credit - $20.00 automatic weekly transfer to savings). However, after viewing the transactions on our bank account's website, I found a notation by the credit that said "provisional". Puzzled, I asked:

I have another question, actually. Beside the reimbursement deposit, it says "provisional". What does that mean?

Suntrust responded with:

You're most welcome, Lisa. We're really glad we could help. That kind of notification would come from your local authorities if a police report was filed. The credit to your account is provisional, or temporary, until we complete our investigation. If your case is approved, the credit becomes permanent. You will be notified of our final decision via letter. If you have any further questions regarding the claims process, you may contact one of our specialists at 800-447-8994.

I wrote back:

Okay, that is very upsetting, because you had already given us a credit on 4/16, only to take it away again just a few days later. The branch manager told us it would be fine to spend the temporary credit, and that the "real" reimbursement would be in our account 3-5 days later. She also mentioned that the temporary credit and the "real" credit would likely overlap, and that both would briefly be in the account at the same time. That didn't happen. It's a good thing I was hesitant to spend the temporary credit, or the account would've been more in the hole than it already was! How long is the investigation going to take? For obvious reasons, I am again reluctant to spend this temporary credit for fear it'll be taken away just like before. By the way, the woman who called me, Veronica, mentioned NOTHING about this being another temporary credit. Again, how long until this is finally settled? Is there anything my husband and I can do to speed up the process? Do you want proof that we were here in our hometown on the days that the fraudulent charges were made in Atlanta, 1-1/2 hours away? To restate my original message above, I hope this issue is resolved by 4/26 as promised, so that we can remain a Suntrust customer. 4/26 will be 10 days, even though we were originally told 3-5 days. If you need to call me, please do so after 4:30pm eastern. We sleep days due to our work schedule.

Afterwards, I was so upset that I spent two hours in the bathroom, doubled over in pain, physically ill because of the stress.

Here is the voice message from Veronica with Suntrust. Do you hear her say ANYTHING about this being temporary? No, I don't either! (The bleeps are where she was saying my last name, which I did not want posted on the internet.)

Wednesday, 4/24/13

Suntrust said:

We're sorry that you received conflicting information, Lisa. If you would like to discuss your case in detail, please contact one of our specialists at 800-447-8994, or send us an email including your preferred contact number to askSunTrust@SunTrust.com, so we may have a specialist reach out to you.

I wrote back:

Okay, I called the 800 number. After waiting for almost 20 minutes for someone to pick up, I was told that there is NOTHING she could tell me regarding the investigation. No status, no time frame, NOTHING. The woman (who rudely kept interrupting me!) also said it could take SIXTY DAYS. That is NOT ACCEPTABLE. We were told 3-5 days, then 10 days. We are the victims here. This was not our fault. Yet it's beginning to feel like WE are the ones being investigated! If necessary, we will escalate this with the appropriate agencies, and will not hesitate to contact our lawyer, the media, and will post reviews of this horrible experience online. It's becoming obvious that changing back to Suntrust bank last year was a mistake, to the tune of $303.57. We cannot and will not just let this go. If this isn't rectified by Friday, 4/26 (the 10 days that was promised), we will no longer bank with Suntrust. If you'll notice, we've already withdrawn nearly all of our money for safekeeping. We banked with you for years, back when you were "American National Bank" in Chattanooga. We financed a vehicle with you, which we paid off exactly as scheduled. Our accounts have always been on excellent terms. You have NEVER had a single problem with us, EVER. And now look how we're being treated.

Suntrust became very patronizing:

We are sorry that you are not satisfied with the provisional credit provided, Lisa. We try our best accommodate our clients during the dispute process and offering a provisional credit is our way of making sure our clients are not inconvenienced while we follow the mandatory process of investigation. We will share your feedback with our leadership team.

I wrote back:

Oh, I'll be "sharing (my own) feedback" with your "leadership team" every single day until this is resolved. Your "provisional credit" is nothing but a temporary loan that you can obviously take back at any time you see fit. You've taken it back once already, and if we had spent that money like you said we could, our balance would have been in the hole worse than it was. We are not touching that money until it is permanently credited to our account. It's stressful enough that some creep stole our hard-earned money, but it's quickly becoming even more stressful trying to sort this out with the very people who are SUPPOSED to have our backs!

Here are screen captures of all the Facebook messages (last names and profile photos have been edited out). There are some additional comments from friends, including a lady who is going through the exact same situation, with Suntrust being just as unhelpful to her as they are being to us.

As stated previously, Suntrust has until the end of the business day on Friday, 4/26/13 (10 days as they stated) to resolve this, and to have the money PERMANENTLY in our account. A temporary credit that may or may not actually stay in the account is not acceptable. We do not spend money that we are not SURE we have.

On Saturday morning, 4/27/13, we will be going to Tennessee Valley Credit Union and possibly to Regions Bank to discuss opening an account with them. The rest of the weekend will be spent filing complaints with the FDIC, the Better Business Bureau, and other appropriate agencies, contacting the media, posting multiple negative reviews online, and anything else we can think of to get the word out about Suntrust's treatment of their (previously!) loyal customers.

Suntrust, you have today and tomorrow to make things right. If there is a legitimate reason for a delay, TALK TO US. Stop patronizing us, interrupting us, giving us incorrect and inconsistent information, and refusing to tell us what's going on.

.........

Some links for later use, should they become neccessary.

http://www.fdic.gov/regulations/laws/rules/6500-3100.html

http://www.fdic.gov/consumers/consumer/news/cnspr06/debitcard.html

http://www.federalreserve.gov/faqs/credit_12666.htm

https://www.ftccomplaintassistant.gov/

http://chattanooga.bbb.org/Find-Business-Reviews/name/suntrust/37421/

http://www.willardlawoffice.com/Law/Home.html

http://www.yelp.com

http://www.mybanktracker.com/Suntrust-Bank/Reviews

http://www.ripoffreport.com/directory/suntrust-bank.aspx

http://www.bankfox.com/b/suntrust-bank/reviews/

http://www.depositaccounts.com/banks/suntrust-bank.html

https://www.creditkarma.com/reviews/banking/single/id/suntrust-bank

https://www.facebook.com/suntrust

http://screwedbysuntrust.com/

http://suntrust.pissedconsumer.com/

http://www.my3cents.com/reviews/suntrust

http://www.customerservicescoreboard.com/SunTrust

http://www.complaintsboard.com/complaints/suntrust-bank-valdosta-georgia-c148411.html

......

Thursday, 4/25/13

After much discussion, Robert and I decided to go ahead and check out Tennessee Valley Federal Credit Union this morning. We ended up opening accounts there, and Robert's employer is processing the paperwork to change over his direct-deposited paychecks. We were going to wait until Saturday, but after considering what a fiasco this has been, we decided to go ahead.

Late this afternoon we received an e-mail from Suntrust saying:

Mr. and Mrs. (last name edited out),

Thank you for your email below and for giving us the opportunity to look into this matter for you.

Your email and the additional details you provided were escalated to our Fraud Assistance Center. The case was reviewed by one of our investigators and has been approved. The provisional credit issued to your account is now final. You will receive a confirmation letter at the address on file within the next 7-10 business days.

We hope we have addressed your concerns and we apologize for any inconvenience this situation has caused you.

Sincerely,

Veronica Ortega

Social Media Client Engagement Specialist

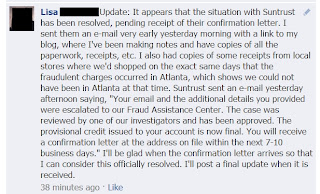

Here's a screen capture of that e-mail:

We find it interesting that they apparently didn't do a darn thing until I provided proof that we were NOT in Atlanta on the dates the fraudulent activity occurred. Maybe it's a coincidence, but it sure is odd.

I, for one, will be happy when that confirmation letter arrives in the mail.

I made an additional post on Suntrust's Facebook page:

We still plan on closing our Suntrust accounts on Saturday. There were too many bank errors made, too much conflicting information given, outright lies told, and no straightforward answers provided. The rude woman who kept interrupting me, raising her voice, and not letting me explain the necessary facts of the situation pretty much sealed the deal. We are unwilling to deal with Suntrust's inadequate support staff again, should another problem occur in the future (heaven forbid!).

Apparently I'm not the only person who has experienced problems with Suntrust. Look at the complaints on their Facebook page. (Click where it says "Recent Posts By Others On Suntrust".)

https://www.facebook.com/suntrust

Friday, 4/26/13

To anyone else that may be going through this, regardless of where you bank: WRITE DOWN EVERYTHING as it happens, including dates, times, and names of the people you speak with. KEEP COPIES OF EVERYTHING, including screen captures of your online account, e-mails, notifications received in the mail, receipts, voice messages, screen captures of online responses such as the bank's Facebook page, police reports, etc. In other words, hang onto ANYTHING that might important later on, even if it doesn't seem important at the time.

If you decide to keep track of things in a blog like I did, be ***ABSOLUTELY SURE*** to edit out any personal information, such as your account numbers, SS numbers, case numbers, your full name, your address, etc. You don't want that information floating around on the internet.

This blog was created on the Blogspot.com / Blogger.com website (it's free).

Saturday, 4/27/13

We received this letter in the mail from Suntrust, stating that the $303.57 deposit was temporary. I hope to goodness that this letter was sent before the e-mail saying it was final. That confirmation letter has not yet arrived.

Tuesday, 4/30/13

Remember we CLOSED the savings account and the new checking account on Friday, 4/26/13, and withdrew the rest of the money in those accounts? We also had an automatic transfer that moved $20 every Tuesday from the older/deposit checking account into the savings account. We made sure that was cancelled as well. The only account left open is the older/deposit checking account because that's where Robert's check is direct-deposited. (His employer has been advised to change it ASAP, but sometimes it takes them a week or two to change things over.) We left $30 in that account.

Guess what! Suntrust apparently did NOT close those two accounts, and they did NOT stop the automatic transfer!

Above: Accounts Overview

Above: $20 automatically transfered from the Deposit checking account and into the SUPPOSED-TO-BE-CLOSED Savings account.

Above: The $20 automatic transfer in the Savings account

It is absolutely unbelievable to me that such a large, (supposedly!) highly-rated company can be THIS INCOMPETENT! It looks like we get to call or go by there yet again to straighten this new error out. I guess it's a good thing I left $30 in there, just in case.

Interestingly, I checked on Suntrust's BBB rating at the beginning of all this mess. They either had an A or an A+ rating (I forget which). I checked again last week, and they were down to a B+. They remain at B+ as of the date of this post.

We have received the confirmation letter from Suntrust saying that the provisional credit is now final (copy below). We are considering the matter resolved.

It has come to my attention via a local newspaper article that Mapco gas stations had malware installed on all their systems between 3/19-25, and in certain other stores on other dates. We purchased gas at a Mapco station on 3/24/13 (copy of receipt below). We strongly believe that THIS was the source of the compromise, and NOT us using our debit card at a tampered-with ATM as we were originally told by Suntrust. Here is the link to the newspaper article: http://www.wrcbtv.com/story/22175705/mapco-customers-may-be-at-risk

And there is a wealth of information about this security breach on Mapco's website at http://www.mapcoexpress.com/ Here are a few relevant screen captures:

And below is where I followed up on Suntrust's Facebook page. I said, "Okay, the confirmation letter has been received, so I am considering this resolved. It has come to our attention that Mapco gas stations had malware installed on all their systems between 3/19-25, and in certain other stores on other dates. We purchased gas at a Mapco station on 3/24/13. We strongly believe that THIS was the source of the compromise, and NOT us using our debit card at a tampered-with ATM as we were originally told. We rather resent Suntrust treating us as if we'd simply been careless with our debit card, and that we were made to feel as if WE were the ones being investigated, especially in light of this new information. We closed our Suntrust account today, not because of the money being stolen, but because of the poor manner in which this was handled."

Suntrust assures us that the accounts ARE closed, so hopefully they won't magically open again like they did before.

Tuesday, 5/7/13

Guess what! The compromised account is STILL showing as being open. What the heck is so complicated about closing an account? I have never in my life had this much trouble with a bank. Geez Louise! Bad thing is, they charge a monthly fee if you don't have at least one direct deposit during that month. If they're holding out to try to get a monthly fee out of us, or hoping that the direct deposit hasn't been changed, they'll be very disappointed. I just sent a message to them on their online customer service form, seeing as how the nearest branch office is apparently incapable of performing such a simple task. Edit: My log-in has been disable, so it appears now that the accounts have finally been closed. I hope.

Check this out. The local news allows comments to be made by their readers on their stories, and a number of people have posted comments that their cards, too, were compromised. Notice that one comment says their card was used at Kroger in Atlanta, and also at gas stations in Atlanta all the way to Florida! Sound familiar? Luckily MasterCard started declining our card before the thief (thieves?) reached Florida, so it could've been a LOT worse. This is an unbelievable mess that likely affects hundreds of people. (I'm "Lisa" in the comment section.) Link to the news page: http://www.wrcbtv.com/story/22175705/mapco-customers-may-be-at-risk

I received an e-mail saying there is a message for me in my account, and that I should log in to read it. Um ... hello? Suntrust sends a message, AFTER disabling my log-in, knowing I CANNOT log in to read it? Sigh! I posted a comment on Facebook.

This comment has been removed by the author.

ReplyDelete

ReplyDeleteThe NetSpend Card is being issued by four different banks which are the BofI Federal Bank, Republic Bank, Bancorp Bank and MetaBank.It's easy to manage your Nordstrom credit or debit card online. Find links for applications, billing and payment options and more at Nordstrom

suntrust-card-activation

* LETS JOIN AND FEEL SENSATION TO PLAY *

ReplyDeleteVideo Adu Ayam

Video Sabung Ayam

Adu Ayam Sampai Mati

Adu Ayam Bangkok

Adu Ayam

Ayam Bangkok

Jadwal Bola Malam Ini

* VISIT OUR SITE AT *

www.bakarayam.co

* ONLY HERE YOU CAN FEEL CONTINUOUS VICTORY *

http://gulaiayammarketing.blogspot.com/2018/10/terungkap-khasiat-daging-kambing-untuk.html